CONTACT US

You can find us at

info@embelmanagement.com

PHONE NUMBER

323-312-3879

LOCATION

9350 Wilshire Blvd, Beverly Hills, CA 90212

info@embelmanagement.com

323-312-3879

9350 Wilshire Blvd, Beverly Hills, CA 90212

Our selection process emphasizes key values that we seek in our long-term partners. We look for individuals and organizations that share our goals and core values.

The timing to join our investment funds depends on the specific fund you are interested in. Our Short-Term Flexible Fund is available for investment with a minimum lock-up period of 3 months. Once the lock-up period is completed, you can provide a 1-month notice to receive your funds. The Embel Develop Fund has a lock-up period of 6 months, and if you wish to redeem your investment, a 90-day notice is required. The Deal-Based Fund is only accessible when there is a specific investment opportunity, and the lock-up period aligns with the duration of the deal.

The average returns disclosed in our quarterly reports represent the overall average returns for all investors in the fund. While each unit receives the same distribution, the purchase price of units may vary among investors. The disclosed average tends to reflect the lower end of the price range since higher-priced units have been acquired over the years.

For any changes to your account, including distribution preferences, contact information updates, payment information updates, redemptions, or transfers, please feel free to contact us via email at invest@embelmanagement.com.

Contrary to popular belief, Lorem Ipsum is not simply random text.

Address:

9350 Wlishire Blvd. Suite 323 Beverly Hills, CA 90212

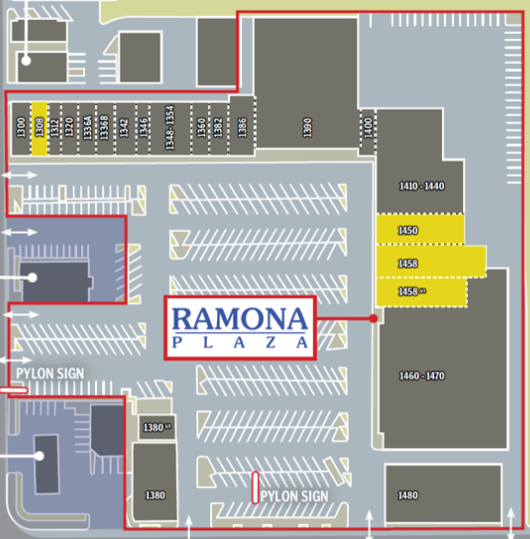

ASSET TYPE:

Retail

PROPERTY CLASS:

B

TOTAL UNITS :

7

REANTABLE SF :

227,814

YEAR BUILT:

1973

TARGET INVESTOR IRR

36.00%

TARGET CASH ON CASH

18.00%

TARGET EQUITY MULTIPLE:

2.08x

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

Contrary to popular belief, Lorem Ipsum is not simply random text.

Address:

9350 Wlishire Blvd. Suite 323 Beverly Hills, CA 90212

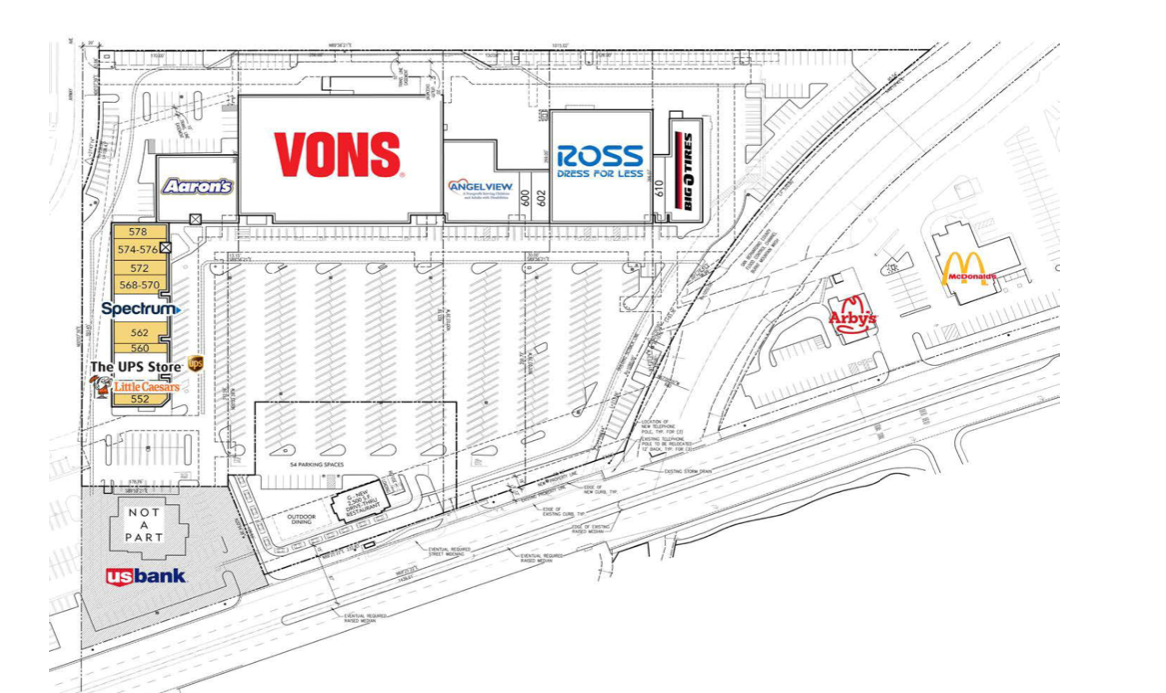

ASSET TYPE:

Retail

PROPERTY CLASS:

B

TOTAL UNITS :

7

REANTABLE SF :

227,814

YEAR BUILT:

1973

TARGET INVESTOR IRR

36.00%

TARGET CASH ON CASH

18.00%

TARGET EQUITY MULTIPLE:

2.08x

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

Contrary to popular belief, Lorem Ipsum is not simply random text.

Address:

9350 Wlishire Blvd. Suite 323 Beverly Hills, CA 90212

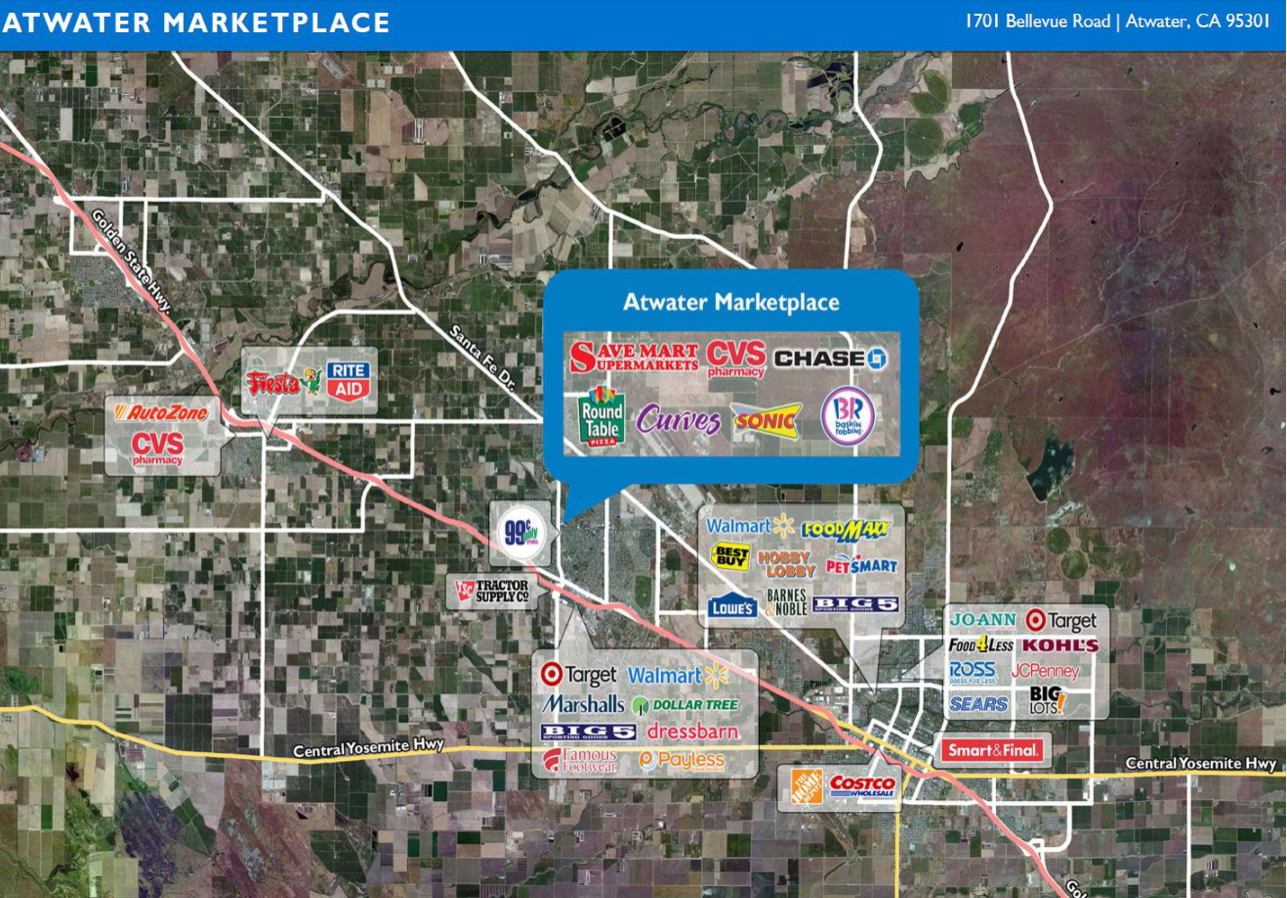

ASSET TYPE:

Retail

PROPERTY CLASS:

B

TOTAL UNITS :

7

REANTABLE SF :

227,814

YEAR BUILT:

1973

TARGET INVESTOR IRR

36.00%

TARGET CASH ON CASH

18.00%

TARGET EQUITY MULTIPLE:

2.08x

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

Contrary to popular belief, Lorem Ipsum is not simply random text.

Address:

9350 Wlishire Blvd. Suite 323 Beverly Hills, CA 90212

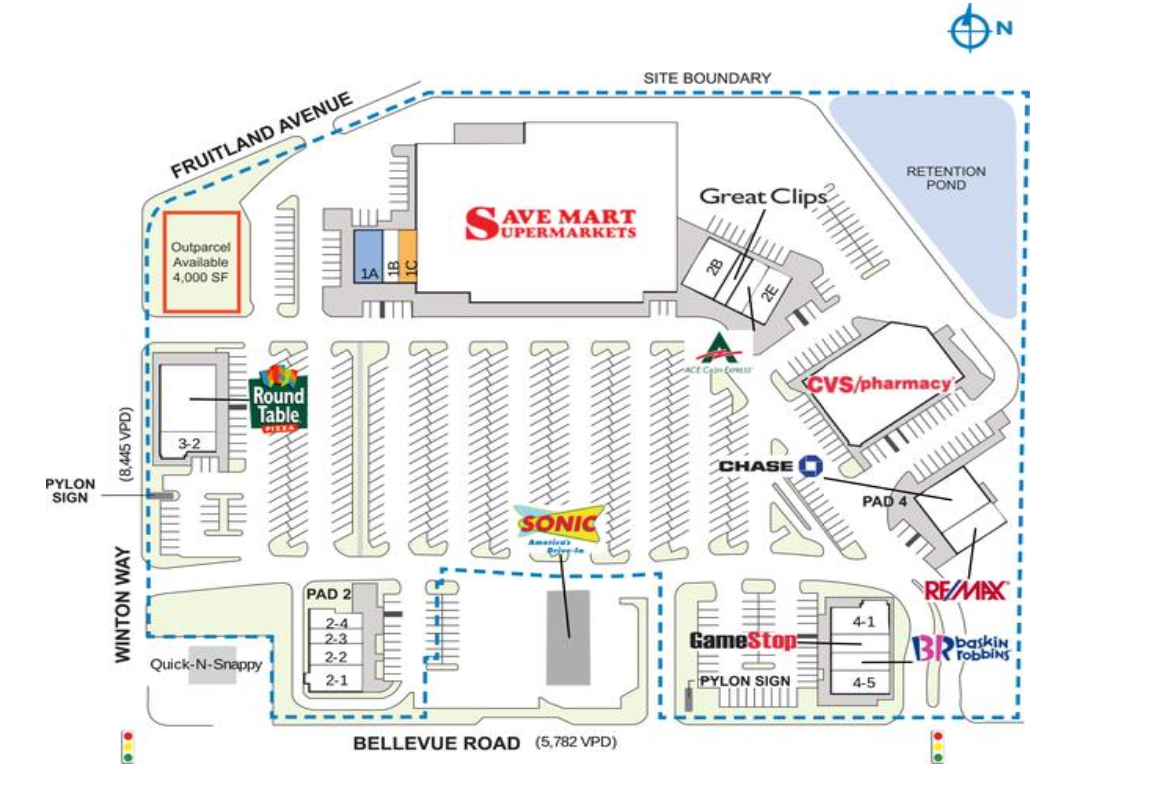

ASSET TYPE:

Retail

PROPERTY CLASS:

B

TOTAL UNITS :

7

REANTABLE SF :

227,814

YEAR BUILT:

1973

TARGET INVESTOR IRR

36.00%

TARGET CASH ON CASH

18.00%

TARGET EQUITY MULTIPLE:

2.08x

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

Contrary to popular belief, Lorem Ipsum is not simply random text.

Address:

9350 Wlishire Blvd. Suite 323 Beverly Hills, CA 90212

ASSET TYPE:

Retail

PROPERTY CLASS:

B

TOTAL UNITS :

7

REANTABLE SF :

227,814

YEAR BUILT:

1973

TARGET INVESTOR IRR

36.00%

TARGET CASH ON CASH

18.00%

TARGET EQUITY MULTIPLE:

2.08x

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

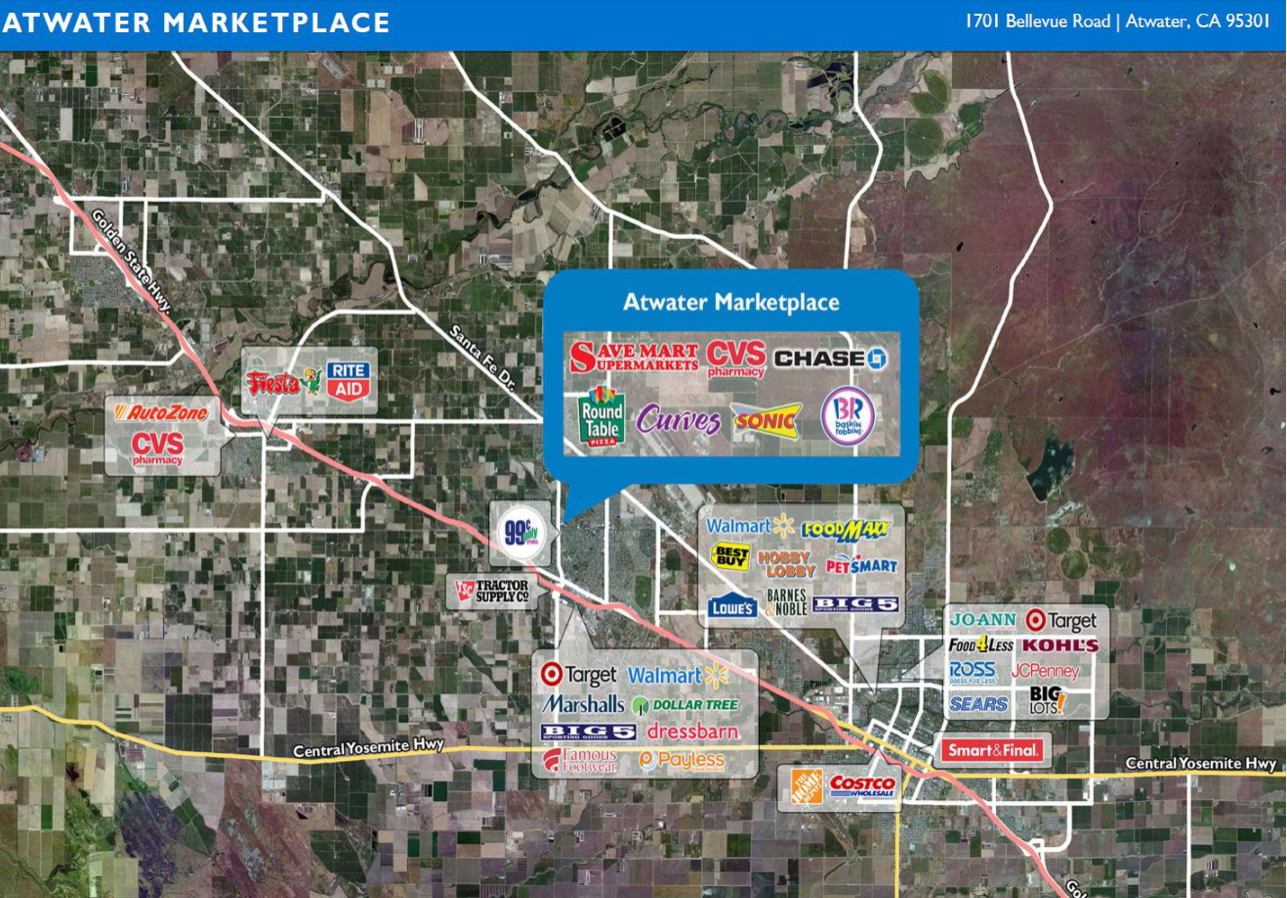

At Embel Management, we excel in acquiring and managing large commercial retail centers

36.00%

18.00%

36.00%

TARGET Raise

$11,690,000

TARGET CLOSE

06/30/23

FUNDS DUE

06/28/23

MInimun investment

$100,000

investment Period

3 YEARS

PREFERRED return

7%

DISTRIBUTION SCHEDULE

QUARTERLY

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipisicing elit. Quidem, provident.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipisicing elit. Quidem, provident.

Our consulting services provide you with expert guidance to make informed decisions about your investment portfolio. We conduct a comprehensive analysis of market trends, risk management strategies, and asset allocation to optimize your investments.With a focus on transparency and communication, we provide you with the information needed to make sound investment decisions.

Efficient and effective management of your investment properties is our specialty at EMBLE. We take a proactive approach to identify and address potential issues, from routine maintenance to emergency situations, to maximize returns. Our experienced team handles every aspect of property management, including tenant communication, rent collection, and lease renewals, giving you peace of mind.

Embel’s investment services are customized to meet your unique needs and goals. Collaborating with you, we understand your investment objectives and risk tolerance to create a tailored investment strategy.Our team rigorously researches and evaluates investment opportunities across commercial real estate to private equity to generate sustainable returns.